How Much Down Payment Do You Need to Buy a Home in Hoover, AL?

Confused About Down Payments? You’re Not Alone.

If you're thinking about buying a home in Hoover, Alabama, one of the first questions that probably comes to mind is:

"How much do I need for a down payment?"

Many homebuyers believe they need to put down 20%—but the truth is, there are plenty of options available, including low or even no down payment programs that can make homeownership more accessible.

Whether you're a first-time buyer, upgrading, or relocating to Hoover, understanding your down payment options can help you make smarter decisions and move forward with confidence.

What Is a Down Payment?

A down payment is the portion of the home’s purchase price that you pay upfront at closing. The rest is covered by your mortgage.

For example, if you buy a $300,000 home and put down 10%, that’s $30,000 upfront and $270,000 financed through your loan.

Common Down Payment Options in Hoover, AL

💼 1. Conventional Loan (3% – 20% Down)

Ideal For: Buyers with good credit and steady income.

Minimum Down: As low as 3% for qualified buyers.

Pros: Competitive rates, can avoid mortgage insurance with 20% down.

Example: For a $350,000 home, 5% down equals $17,500.

Conventional loans are popular in Hoover's mid-range neighborhoods like Southwood, Deer Valley, and Lake Crest.

🏠 2. FHA Loan (3.5% Down)

Ideal For: First-time or lower-credit-score buyers.

Minimum Down: 3.5%

Pros: Easier approval standards, low down payment.

Cons: Requires mortgage insurance (MIP).

This is a great option for buyers looking in Hoover’s affordable areas, such as Chapel Creek or Patton Chapel.

🎖️ 3. VA Loan (0% Down)

Ideal For: Veterans, active-duty military, and eligible spouses.

Minimum Down: 0%

Pros: No down payment, no private mortgage insurance (PMI), lower rates.

Cons: Must meet VA service requirements.

If you’ve served in the military and are looking to buy in Hoover, this is one of the most cost-effective mortgage options available.

🌾 4. USDA Loan (0% Down)

Ideal For: Buyers purchasing homes in USDA-eligible areas.

Minimum Down: 0%

Pros: No down payment, low mortgage insurance.

Cons: Must meet income and location eligibility.

Many outskirts of Hoover and nearby rural suburbs may qualify for USDA financing.

💰 5. Down Payment Assistance Programs (DPA)

Hoover buyers may also benefit from state and local programs such as:

Step Up (by the Alabama Housing Finance Authority)

First-time homebuyer grants

Forgivable second mortgages

These programs can cover part or all of your down payment, helping you get into a home sooner than you thought possible.

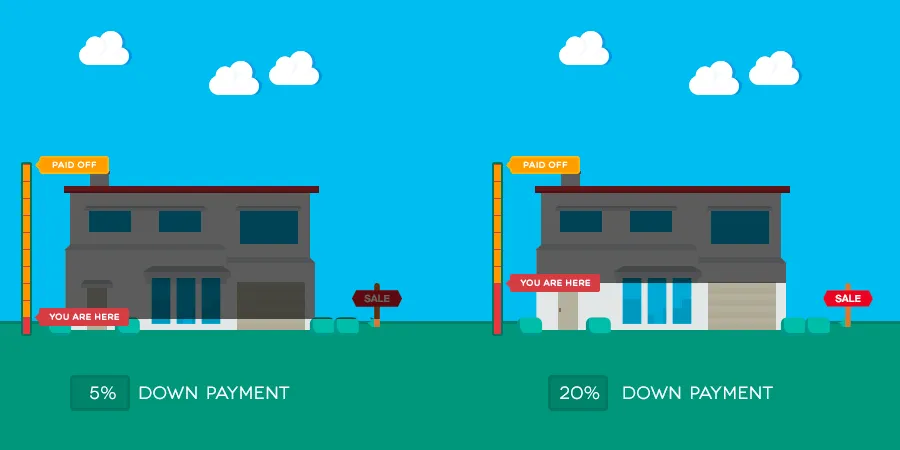

How Much Should You Put Down?

The right amount depends on your:

Budget

Credit score

Monthly payment comfort level

Loan eligibility

Consider:

Higher down payment = lower monthly payments + no PMI (at 20%)

Lower down payment = more flexibility now, but higher monthly cost

Let’s crunch the numbers together to help you find the sweet spot that works for your lifestyle and long-term financial goals.

Hidden Costs to Budget Alongside Your Down Payment

Don’t forget these additional costs when buying in Hoover:

Closing costs (2%–5% of purchase price)

Home inspection & appraisal

Prepaid property taxes & insurance

Moving and setup costs

Pro tip: Many sellers in Hoover are open to contributing toward your closing costs—especially when working with a skilled negotiator.

Why Hoover, AL Is a Smart Market for First-Time and Repeat Buyers

With its top-rated schools, safe neighborhoods, and easy access to Birmingham, Hoover continues to be one of Alabama’s most desirable cities for homeowners.

Whether you're looking in Greystone, Bluff Park, or a newer community like The Preserve, there’s a home—and financing option—that fits your goals.

Conclusion: Start Smart with the Right Down Payment Strategy

Buying a home in Hoover, AL doesn’t require a 20% down payment. Whether you have savings ready or need help exploring zero-down options, you have choices—and I’m here to help you navigate them.

Let’s talk about your goals, connect you with trusted lenders, and create a step-by-step plan that gets you into a home that fits your budget and lifestyle.

Contact Benny Roberts – Your Trusted Hoover Real Estate Advisor

📞 Call: (205) 332-7701

📧 Email: [email protected]

🌐 Visit: bennyroberts.com

Let’s find out how close you really are to homeownership. Hint: It may be closer than you think.